Part I Section 901.—Taxes of Foreign Countries and of Possessions of the United States 26 CFR 1.901-2: Income, War Profits, o

English Tax form sa108 Residence remittance basis etc from HM revenue and customs lies on table with office items. HMRC paperwork and tax paying proce Stock Photo - Alamy

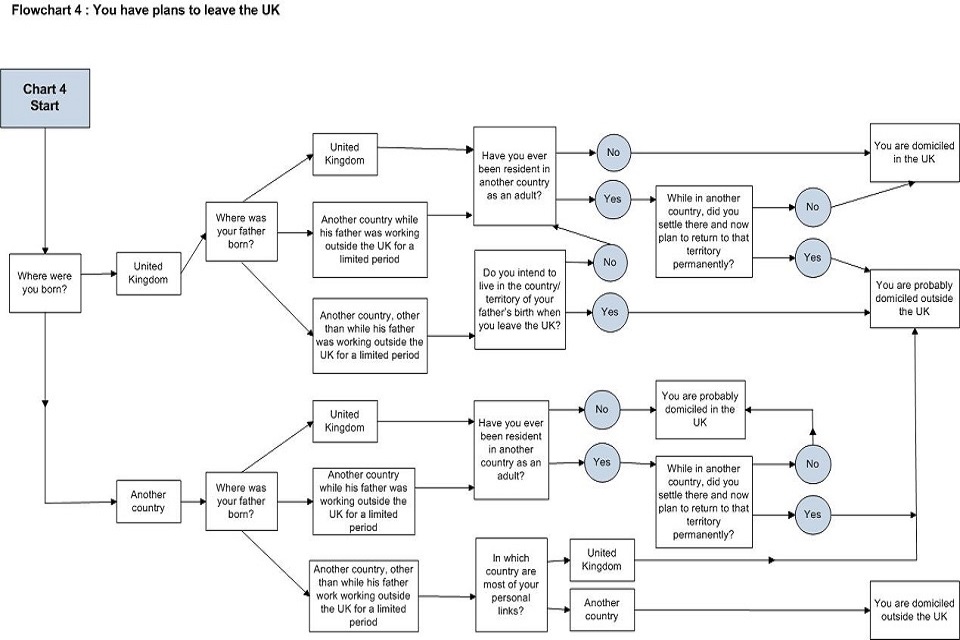

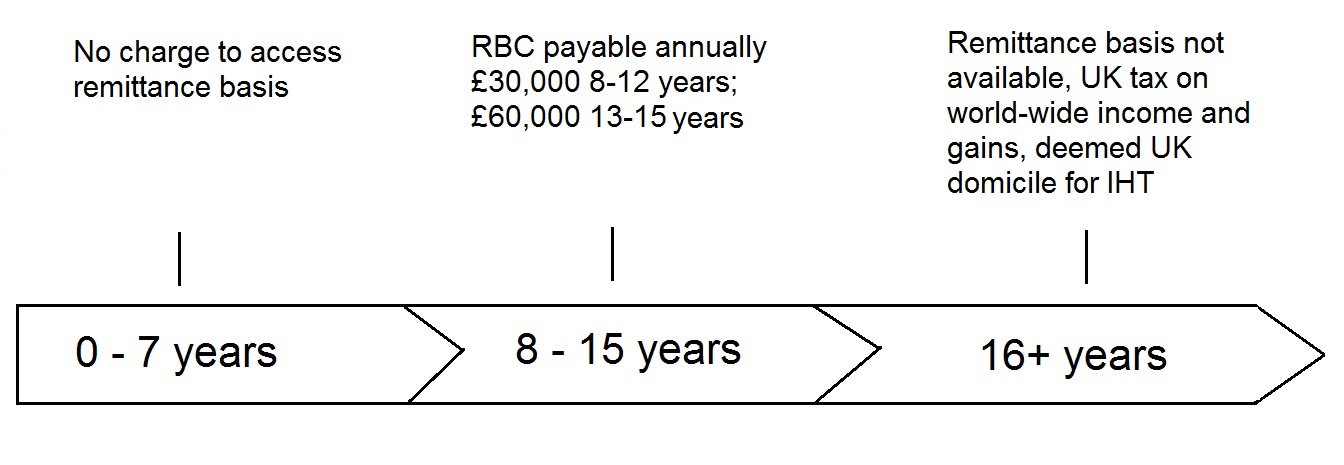

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

Malta: Commissioner publishes first ever guideline on remittance basis of taxation | International Tax Review

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

English Tax form sa108 Residence remittance basis etc from HM revenue and customs lies on table with office items. HMRC paperwork and tax paying proce Stock Photo - Alamy

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global